Top 5 Benefits of Using Virtual Cards for Subscription Services in 2025

Subscription services have become a key part of how we access the things we enjoy and need.

From streaming platforms like Netflix that keep us entertained to the software tools we use for work, learning, and staying productive, these services have become essential for everyday activities.

They allow us to pay for access to content and services without the need for physical purchases, making it easier to stay connected and entertained from anywhere.

However, keeping track of all those recurring payments can quickly become overwhelming unexpected charges, forgotten free trials, and security concerns can all add up.

Virtual USD Cards offer a more convenient and reliable way to manage your subscriptions.

These cards allow you to sign up for free trials, manage long-term memberships, and keep track of your spending with convenience.

They provide greater security and flexibility, helping you avoid the frustrations of rejected payments or extra charges, especially when making international purchases.

If you've ever tried to make an international payment with your Naira card, only to face failure or restrictions, you know how frustrating it can be.

Trying to shop on Amazon or pay for services like Apple Music often leads to complications with traditional cards.

Virtual USD Cards eliminate these barriers, allowing you to make payments without the usual stress.

Now, you may be asking: why choose a Virtual USD Card over a traditional one?

We’ll break down the top 5 benefits of using Virtual Cards for subscription services in 2025, and show you why LaserCards is the perfect platform to get started today.

What Makes a Virtual USD Card Essential?

You might be wondering, “What makes a virtual USD card a better option?” Well, here’s the deal:

If you’ve ever tried making online payments for services like Amazon, Spotify, or Netflix using your local Naira card, you’ve probably faced some issues.

Some transactions might fail, or your card might not even work for international payments.

Virtual USD cards open up the world of international transactions, helping you get around these obstacles.

On top of that, virtual cards are quick, secure, and ideal for online shopping and subscription management.

They keep your actual bank account details safe, so you can shop, stream, and subscribe without concerns.

Virtual USD Cards vs. Physical Cards: A Closer Look

You may wonder, “What’s the difference between a virtual USD card and a traditional physical card ?” Let’s compare:

- Online Accessibility

With a physical card, you’re limited to using it at physical stores or ATMs, while a virtual card is specifically designed for online payments.

You don’t need to carry it around or worry about it getting lost or stolen. - Security

Virtual cards are often more secure because they don’t expose your actual bank account details.

You can create unique, disposable card numbers for each transaction. If the card number is compromised, you simply delete it and generate a new one. - Instant Setup

A virtual card can be set up within minutes, whereas a physical card requires you to go to a bank, wait for approval, and wait even longer for the card to arrive in the mail. - Usage Restrictions

Virtual cards are mainly used for online purchases, subscriptions, and international payments.

A physical card, on the other hand, can be used both online and in-person.

However, physical cards may come with international transaction fees, unlike virtual cards, which allow direct dollar payments without extra fees.

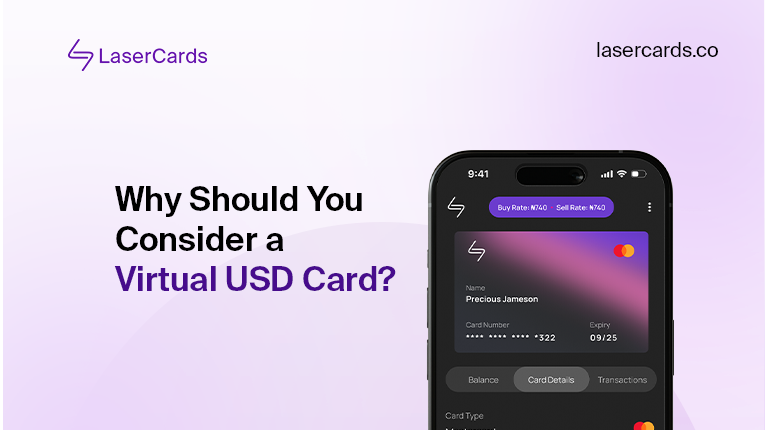

Why Should You Consider a Virtual USD Card?

Still not convinced? Here are five compelling reasons why you should seriously consider using a Virtual USD Card for your online purchases.

1. Instant Access for International Payments

One of the biggest challenges with using traditional Nigerian bank cards for international transactions is that they often don’t work.

Trying to pay for a subscription to Netflix, buy a game on Steam, or purchase software on Amazon can lead to your Naira card being rejected due to foreign currency issues or restrictions on international transactions.

With a Virtual USD Card, you can bypass these limitations. You get an international payment method that works seamlessly across borders.

This is particularly useful for Nigerians who want to subscribe to services that only accept payments in USD or other foreign currencies.

For example, say you want to sign up for Apple Music. When you use a physical Naira card, the payment may be rejected because it’s not in USD.

However, with a Virtual USD Card, the payment goes through easily because it’s denominated in the exact currency required.

2. Enhanced Security for Online Transactions

When shopping or subscribing online, security is crucial. Using your regular bank card for online payments exposes your actual bank details, making them vulnerable to hackers and fraudsters.

But with a Virtual USD Card, your real bank information is kept private.

For instance, if you’re buying something from a less secure platform, a hacker might get hold of your card details. If you’re using a physical card, they could have access to your full account.

However, with a Virtual Card, even if someone steals the card details, they can only use it for the specific transaction you’ve authorized.

Once the payment goes through, you can delete the card, rendering it useless to anyone who may have stolen it.

This added layer of security ensures that your money stays safe, and it gives you peace of mind every time you make an online purchase.

3. Complete Management of Your Spending

Have you ever been hit with an unexpected charge on your card for a subscription you forgot to cancel?

It’s a frustrating experience, especially when it comes to services like streaming platforms that auto-renew at the end of a free trial period.

With a Virtual USD Card, you can set spending limits, pause payments, and even delete the card whenever you choose.

This way, you have full control over your subscriptions and can ensure that you don’t get charged for something you don’t want.

Here’s an example: Let’s say you’re trying out a free trial for a service like Spotify.

With your physical bank card, the company can easily charge you once the trial ends, whether you remember to cancel or not.

But with a Virtual USD Card, you can create a card specifically for the trial, and once the trial is over, you can simply delete the card.

No cancellation hassle, and no unwanted charges.

4. Perfect for International Subscriptions and Services

Many Nigerians face the problem of Naira-based cards being declined when trying to subscribe to services like Amazon Prime, Adobe Creative Cloud, or even PlayStation Plus.

Why? Because these services require payments in US dollars, and Naira cards are often blocked for foreign transactions.

With a Virtual USD Card, you avoid the need to worry about conversion rates or whether your payment will go through.

You’ll be able to pay in USD, which not only ensures that your transactions are processed smoothly but also avoids the frustration of your payments being declined.

5. Instant Activation

Gone are the days when you had to wait for a physical card to arrive in the mail.

Applying for a traditional debit or credit card often involves paperwork and long waiting times before you can get your hands on the card.

But with a Virtual USD Card, everything is digital.

From signing up to generating a card, the process is fast and simple. All you need to do is sign up on a platform like LaserCards, fund your account, and within seconds, you can generate a new Virtual USD Card that’s ready to use.

You no longer have to worry about waiting weeks for a card to be mailed to you; everything happens in real-time.

Frequently Asked Questions About Virtual USD Cards in Nigeria

1. What Is a Virtual USD Card?

A virtual USD card is a prepaid digital card made for online payments, especially when you're dealing with international transactions.

It’s not tied to your bank account. Instead, you load it with a specific amount, which makes it perfect for shopping on sites like Amazon or paying for subscriptions like Netflix or Spotify without any issues.

2. Which Is the Best Virtual Card for International Payments in Nigeria?

When it comes to making international payments, LaserCards is a great choice. It’s fast, secure, and easy to get.

Plus, it’s super flexible, making it easy to pay for services or shop from global stores without the usual complications.

3. What Is the Best Card for Online Purchases in Nigeria?

If you're shopping online, especially on international websites, a virtual USD card is the way to go.

Unlike local bank cards, which often run into problems when making international payments, virtual USD cards work smoothly for online transactions, so you won’t have to deal with declines or surprise charges.

4. Can I Use a Virtual Card for Online Payments?

Yes, definitely. Virtual USD cards are perfect for online payments. They work just like regular debit or credit cards but with an added layer of protection.

Since they aren’t linked directly to your bank account, your personal banking info stays secure while you shop, subscribe, or even send money internationally.

5. How Can I Get a Virtual USD Card in Nigeria?

Getting a virtual USD card in Nigeria is easy. You can sign up with LaserCards, pick the card that suits you best, and your virtual card will be ready to use in minutes.

With instant activation and no paperwork, it’s a quick and secure way to start making international payments.

Conclusion

In conclusion, virtual USD cards provide a reliable and convenient way to manage your subscriptions and make international payments.

They offer flexibility, security, and easy access to online services, from streaming platforms to shopping globally.

With instant setup and enhanced protection, virtual cards help you avoid the challenges of traditional payment methods.

For anyone looking to streamline their online transactions in 2025, a virtual card is a smart choice to make your payments safer and more manageable.

Recommended Article: https://blog2.lasercards.co/7-powerful-reasons-to-use-virtual-cards-for-online-payments/